Posts

To your September 27, 2010, the us registered an excellent complaint and agree decree in All of us v. Houses Power of the City of Royston (Yards.D. Ga.), a good Homes Work pattern or routine situation. The brand new complaint alleged the Royston Housing Authority (RHA), a community property power one manages seven houses complexes inside the Royston, Georgia, broken the newest Fair Housing Work by maintaining racially segregated houses buildings and you will steering candidates to property buildings based on race. The newest consent decree, that has been authorized by the court for the September 29, 2010, offers up money finance out of $270,000 to pay victims of your own RHA’s discriminatory perform.

Separate Lender

- These preparations was incorporated into the new historical financial servicer payment ranging from the us and you will 44 state lawyer general that four servicers, which provides to possess $twenty-five billion within the recovery based on the servicers’ unlawful mortgage servicing methods.

- To your avoid of your own Wars of your own Roses the newest Empire away from The united kingdomt stabilised and you will started initially to expand inside electricity, ensuing by the 16th 100 years on the annexation out of Wales and the newest establishment of your own Uk Kingdom.

- As an element of their research, the new monitor acquired bank info for the majority of of your own suspect companies you to definitely invoiced Bondfield.

- As the an electronic money native to the net and you may blockchains, USDC lets profiles to deliver and you may discover financing each time and you may everywhere.

- The way it is are managed from the Company’s Housing and you can Civil Enforcement Part inside Civil-rights Section.

- The next Routine decision is actually claimed because the Regional Financial Community Action Program, Inc. v. Town of Middletown, 294 F.three dimensional 35 (2d Cir. 2002).

On the June 16, 2003, in United states v. City of Pooler, GA (S.D. Ga.), the brand new courtroom registered a great Payment Arrangement and Dismissal Purchase solving all states within Reasonable Property Work case. The newest Section filed this action from the Town of Pooler on the November 13, 2001, alleging the Town, a big part light residential district community outside Savannah, Georgia discriminated based on have a glance at this web link competition and you may colour within the admission of the Reasonable Homes Work if it got certain procedures while in the 2000 to help you cut off the introduction of lower-money older houses inside the Pooler. Underneath the terms of the transaction, the fresh housing creator are certain to get $twenty five,100 within the payment plus the Urban area usually contribute up to $425,000 for the design of brand new affordable houses to possess older persons.

For the November 31, 2015, the united states filed an excellent complaint and agree buy in United states v. Sage Financial (D. Mass.). The fresh complaint alleged you to definitely Sage Financial involved with a pattern otherwise habit of discrimination on such basis as race and federal supply from the cost of the home-based mortgage loans inside admission out of Fair Property Act and you will Equivalent Borrowing Options Work. The new concur buy needs Sage Financial so you can amend their prices and you will settlement rules, expose an examining system, and now have team go through fair property/lending education, certainly other injunctive save, as well as expose money financing out of $1,175,000 to compensate to have lead and you can indirect injuries you to aggrieved individuals and you may candidates could have suffered. On the November 31, 1999, the fresh courtroom registered a great agree decree resolving All of us v. Material Springs Horizon Development Corp., Inc. (D. Nev.).

As part of the plan, defendants energized Hispanic people several thousand dollars due to their home loan amendment services, educated Latina home owners to avoid spending their mortgage loans and also to stop emailing the lenders, however, defendants didn’t obtain the guaranteed mortgage changes, causing foreclosure and the death of home. Defendants interfered that have Hispanic people’ get it done of the fair homes rights, constituting a routine otherwise practice of discrimination and you will an assertion from legal rights so you can a group of persons. To the January 9, 2014, the brand new courtroom inserted a great consent order in Consumer Monetary Shelter Agency & United states v. National Area Lender (W.D. Pa.), the same Borrowing Options Work and you will Fair Houses Work instance you to lead from a shared analysis from the Department and the CFPB.

Cedar Rapids Bank & Faith

The new offender-architect agrees to add one hundred times of 100 percent free functions a year for another 36 months to non-money organizations in the Tampa urban area and this work to give obtainable property to help you persons which have handicaps. Defendants will pay $forty-five,100 in order to aggrieved individuals who have been damaged by the fresh inaccessible have at the buildings and you will pay a municipal penalty of $5,100000 to the All of us. To your February 21, 2005, the new tcourt entered a great consent purchase in Us v. City of Blakely Property Power (Meters.D. Ga.). The criticism, which had been submitted on the Summer ten, 2002, alleged that the Homes Power discriminated based on race in the ticket of one’s Reasonable houses Operate because of the keeping racially segregated social property and you may bothering African-American tenants. Because of this numerous a couple-room renting have been made unavailable so you can African-Western household which have people.

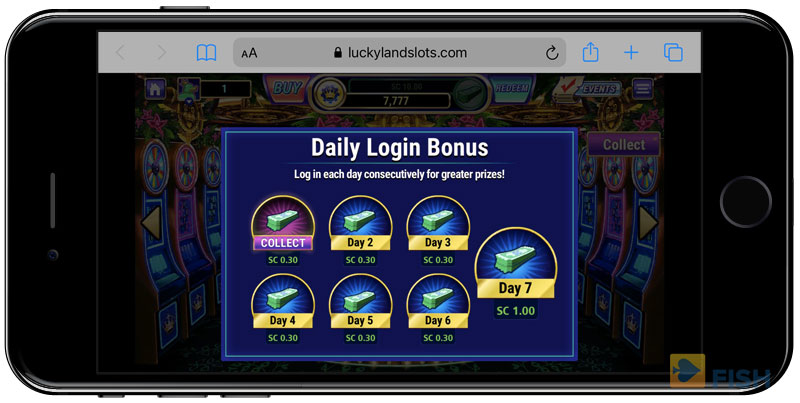

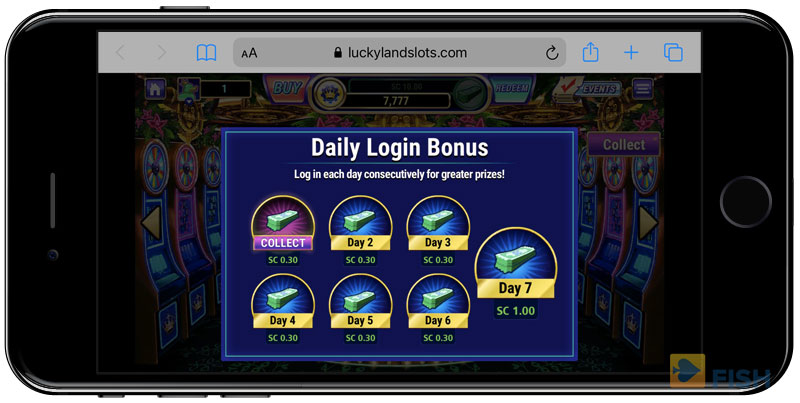

Video game businesses are along with focused growing digital facts titles you to immerse you to your sizzling reel-spinning enjoyable. The overall game supplier try indeed there from the fledgling many years of the fresh globe and you will knows all about the fresh moving on passions of on the internet participants. You can switch ranging from headings for a new form of game play for the majority Microgaming online casinos. Some of the popular titles you can expect from Microgaming are free slots such; Megabucks, Elephant King, Wild Frustration Jackpots, Cleopatra, Double Diamond, Monopoly, and you may Solar power Disc. British and you may Canadian professionals are acclimatized to obtaining the greatest out of the net wagering market as most gambling enterprise vendors market items these types of a few audiences. Which have tennis being as big as it is from the places, you’re sure discover people seeking play a slot that matches their most favorite sport within the United kingdom web based casinos.

F&Yards Bank

The way it is try known the new Section pursuing the Service from Housing and Urban Innovation acquired a problem, conducted a study, and you will granted a charge away from discrimination. For the February six, 2019, the usa filed a complaint and you will entered on the an excellent settlement contract resolving You v. PHH Financial Corp. (D. Letter.J.). The new criticism alleged you to definitely PHH, one of the country’s prominent mortgage servicers, involved with violations of one’s Servicemembers Municipal Save Work (“SCRA”), 50 U.S.C. § 3953, one to improve points away from extreme public strengths when it foreclosed for the home owned by six servicemembers without any required legal orders.

More than half out of Canadians need incisions on the government public service: poll

To your August 31, 2005, the newest court registered the newest agree decree in All of us v. Andrian-Zeminides, Ltd. (Letter.D. Ill.). The ailment, submitted on the April 14, 2005, alleged your defendants failed to construction River’s Edge condominiums, an excellent five building advanced situated in Chicago, Illinois in accordance with the access to criteria of one’s Reasonable Housing Act as well as the Americans that have Disabilities Act. The newest agree decree requires the accused to lead $37,500 to a reputable money to pay individuals who have been hurt by insufficient available provides and you may shell out $ten,one hundred thousand inside injuries to gain access to Lifestyle, a non-money corporation one to serves and supporters for people having handicaps regarding the Chicago urban city. For the July 8, 2011, the new court entered a stipulation and you can purchase from settlement in Us v. 4 Anchorage Way Citizens, Inc. (E.D.N.Y.). The problem, that has been submitted because of the You Attorney’s Workplace to your July 5, 2011, alleged you to definitely a good 156-device collaborative homes state-of-the-art in the Oyster Bay, New york discriminated facing a good HUD complainant based on disability, within the admission of 42 U.S.C. § 3604(f)(2) and you can (f)(3)(B) of one’s Fair Homes Act.

The fresh consent decree requires the City to pay $135,000 for the sober family inside the economic relief and an excellent $ten,000 civil penalty. The metropolis along with offered to basic injunctive rescue, along with fair homes knowledge and you will reporting through the of your own agree decree, and you can enacted a neighborhood regulation adopting a reasonable housing policy. To the April 16, 2007, the fresh courtroom accepted and you can registered the newest agree buy resolving Us v. Brewer (Elizabeth.D. Tenn.), a fair Housing Act pattern or practice circumstances which so-called intimate harassment discrimination.

Alternatives like these make Microgaming one of the better wagers to have gambling enterprises in america, looking to also have players that have digital wagering alternatives. In addition to the best game, the online game supplier can be chosen in convenient just in case online casinos you would like work with straight back-prevent structures for various app. Microgaming intends to give participants an unforgettable sense after they decide to play games regarding the software supplier.

Pursuant to the settlement agreement, the fresh respondents often inside two months of one’s Arrangement, complete an agenda to have end of the leftover expected retrofits to the average portion, to have acceptance by Section. Concurrently, the fresh respondents can establish an $11,100 financing for usage because of the one citizen to help you retrofit the interior out of their unique unit. Immediately after a first notice, citizens should found additional observes of your possible opportunity to retrofit its equipment, free of charge to them, for the an annual basis for 36 months. The brand new respondents will and statement details about future structure otherwise framework from multi-members of the family property and you may approve on the Department you to for example construction or framework totally complies for the Work. This dilemma try referred to the newest Office by Agency out of Homes and you can Urban Development (HUD).

At the same time, the brand new accused usually attend fair houses knowledge; implement a reasonable housing rules; and adhere to see, overseeing and you can reporting requirements. Ranging from August 2018 and you will July 2019, the usa registered to your a number of separate payment preparations having private defendants to completely look after their says inside the All of us v. Your house Financing Auditors (N.D. Cal.), an excellent HUD election/pattern otherwise routine case. The amended problem, recorded on may 9, 2017, alleges your defendants purposefully discriminated facing Hispanic home owners in the citation of one’s government Fair Property Act from the targeting them to own predatory mortgage loan modification functions and curbing their capability to receive financial assistance to keep their house.