When investing in stocks, it’s important to understand the differences between preferred and common stock. Both give you ownership in a company, but they work differently and affect your investments in unique ways. The fundamental accounting equation states that the total assets belonging to a company must always be equal to the sum of its total liabilities and shareholders’ equity. When a company sells shares in an initial public offering, the IPO price is normally well above the par value.

Treasury Stock (Stock Buyback)

Implementing a strong forecasting model can help you maintain optimal safety stock levels while minimizing costs. Also, the desired service factor is crucial in calculating the safety inventory level. This factor considers the level of service you want to provide to your customers, such as maintaining a specific fill rate or avoiding stockouts for the most important customers.

Common Stock and Additional Paid-In Capital (APIC)

- Today, available technology, in large part, can help you manage inventory, conduct accurate forecasts, or even make predictions across the whole supply chain, etc.

- Both common stock and preferred stock have pros and cons for investors to consider.

- In other words, they have a priority claim on the liquidated company’s assets.

- For instance, consider a company’s brand value, which is built through a series of marketing campaigns.

Additionally, in the event of bankruptcy, common shareholders are last in line to receive any remaining assets after bondholders and preferred shareholders are paid. Unlike common stockholders, preferred shareholders usually don’t have voting excel templates rights. This means they have no say in important corporate decisions, such as electing the board of directors or approving major mergers. This can be an important downside for investors who want a voice in the company’s future direction.

Calculator Fields, Terms, and Definitions

This figure is important because it translates a company’s overall performance into per-share metrics, making an analysis much easier regarding a stock’s market price at a given time. If there are 100 shares outstanding and you buy one, you own 1% of the company’s equity. When you buy stock in a company, you buy a percentage ownership of that business. How much of the business your one share buys depends on the total common stock outstanding, a figure you can easily determine using the company’s balance sheet.

Preferred stock gets its name because it has higher priority than common stock for dividend payments and liquidation payments (sales of company assets in the event of bankruptcy). In other words, those shares are preferred over common shares when there’s a question about who gets paid first. As a result, preferred stock dividends are usually higher and more reliable than common stock dividends. Companies can raise, lower or even stop paying their common stock dividends at will, whereas preferred dividends are generally fixed. Common stock represents a residual ownership stake in a company, the right to claim any other corporate assets after all other financial obligations have been met. A company maintains a balance sheet composed of assets and liabilities.

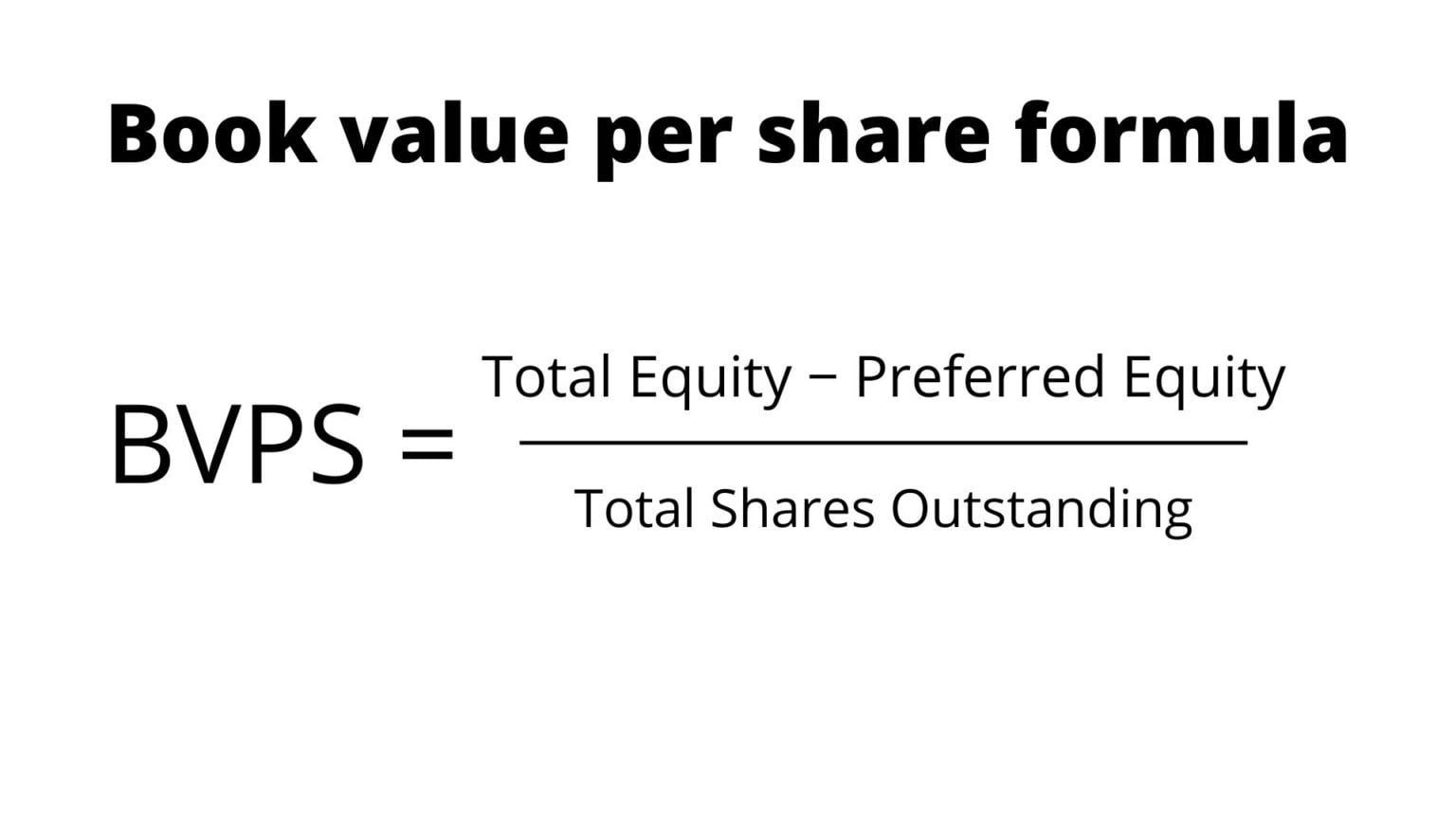

Book Value Per Common Share (BVPS): Definition and Calculation

Instead, as a shareholder, you own a residual claim to the company’s profits and assets, which means you are entitled to what’s left after all other obligations are met. We hope now it is easy for you to calculate common stock and you get valuable information on this topic. A stockholder owns 1% of the company if they possess 1,000 ordinary shares. This investor will get $100 (1,000 shares X $0.10) in dividends if the company announces a $0.10 per share dividend. Let us look at some of the differences between common stock and preferred stock. Without safety stock, you leave your supply chain vulnerable to disruptions.

For example, if a company has 1 million shares of preferred stock at $25 par value per share, it reports a par value of $25 million. When buying a stock, investors don’t have to wonder exactly what type of stock it is. Preferred stock will indicate in the name that the shares are preferred. The value of $60.2 billion in shareholders’ equity represents the amount left for stockholders if Apple liquidated all of its assets and paid off all of its liabilities. These earnings, reported as part of the income statement, accumulate and grow larger over time.

Set your business up for success with our free small business tax calculator. Save more by mixing and matching the bookkeeping, tax, and consultation services you need. Here, we’ll assume $25,000 in new equity was raised from issuing 1,000 shares at $25.00 per share, but at a par value of $1.00. The excess value paid by the purchaser of the shares above the par value can be found in the “Additional Paid-In Capital (APIC)” line item. The pricing method used by the calculator is based on the current dividend and the historical growth percentage.