Ignoring step costs can lead to inaccurate budgeting and decision-making, potentially affecting a company’s financial performance and competitiveness. Recognizing and understanding step costs is essential for effective cost management and strategic business planning. Step costs move up and down in a step-like manner—horizontally over a range, then vertically, then horizontally, and so on.

Step Costs

- There are times, however, when crossing that threshold line for step costs can result in a loss.

- Within this relevant range, managers can predict revenue or cost levels.

- If you look at your business finances, you’ll discover that many of your expenses are examples of step costs.

- However, before he can begin his analysis, he needs to consider the characteristics of the costs.

Likewise, as fewer boats are manufactured, the average fixed costs per unit rises. Because a step variable cost can remain approximately the same while activity levels change, this step effect can impact the allocated cost per manufactured unit. As Figure 2.16 shows, the variable cost per unit (per T-shirt) does not change as the number of T-shirts produced increases or decreases. However, the variable costs change in total as the number of units produced increases or decreases.

Step Cost Explained

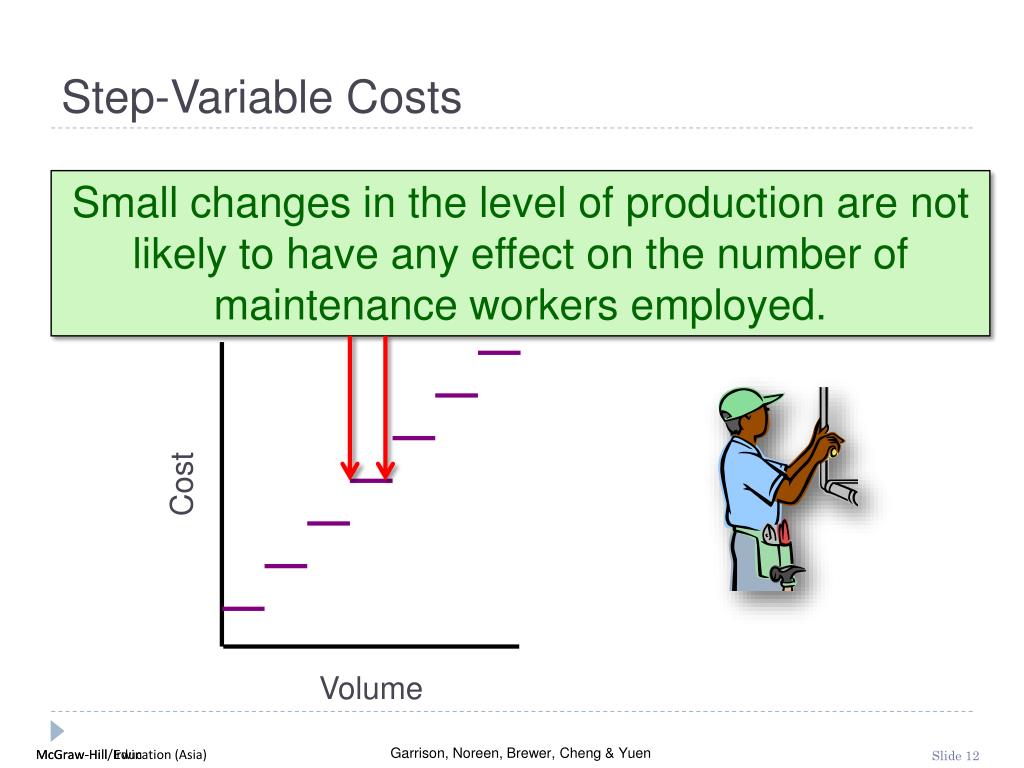

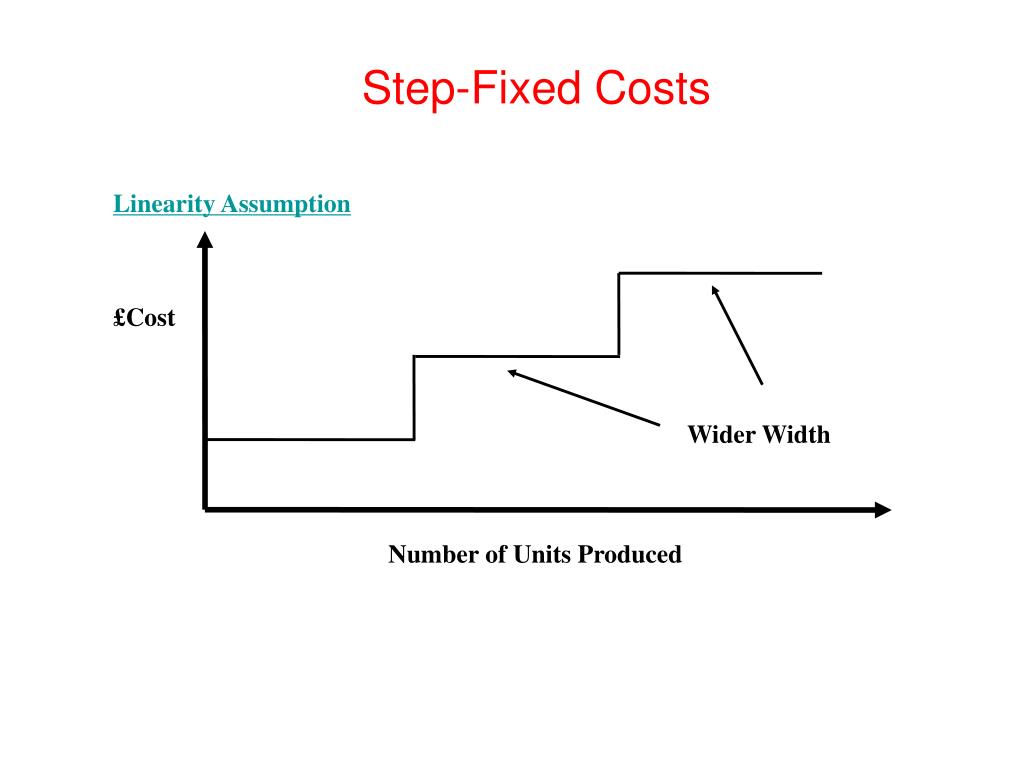

If the total cost increases with small increases in activity, it may be referred to as a step-variable cost. If the total cost will change only with large increases in the quantity of activity, the term step-fixed cost is more likely to be used. Given the importance of step costs to the profitability of a business, it makes sense to clearly identify the activity levels at which these costs will be incurred. As long as management understands when these costs will be incurred, it can plan operations to avoid them for as long as possible, thereby maintaining the highest possible level of profits. Consequently, consider including a discussion of step costs in the annual budget. These expenses are fixed for a certain range of activity, but will increase or decrease beyond a certain threshold level.

Related AccountingTools Course

A step cost remains constant at a certain fixedamount over a range of output (or sales). For example, a local high-tech company did notlay off employees during a recent decrease in business volumebecause the management did not want to hire and train new peoplewhen business picked up again. A stepped cost is also referred to as a step cost, a step-variable cost, or a step-fixed cost. The difference between a step-variable cost and a step-fixed cost has to do with the width of the range of activity.

Mixed Costs and Stepped Costs

Like direct materials, direct labor is typically treated as a variable cost because it varies with the level of activity. However, there are some companies that pay a flat weekly or monthly salary for production workers, and for these employees, their compensation could be classified as a fixed cost. For example, many auto mechanics are now paid a flat weekly or monthly salary. Why is it so important for Bert to know which costs are product costs and which are period costs? Bert may have little control over his product costs, but he maintains a great deal of control over many of his period costs. For this reason, it is important that Bert be able to identify his period costs and then determine which of them are fixed and which are variable.

The average variable cost will be $70.00 per person per day, no matter how many people go on the trip. However, the total variable costs will range from $70.00, if Pat goes alone, to $350.00, if five people go. Figure 2.26 shows the relationships of the various costs, based on the number of participants. The total fixed costs for the trip will be $720.00, no matter whether Pat goes alone or takes up to 4 friends.

Ifthe total direct labor cost increases as the volume of outputincreases and decreases as volume decreases, direct labor is avariable cost. Piecework pay is an excellent example of directlabor as a variable cost. In addition, direct labor is frequently avariable cost for workers paid on an hourly basis, as the volume ofoutput increases, more workers are hired. However, sometimes thenature of the work or management policy does not allow direct laborto change as volume changes and direct labor can be a fixedcost.

Unlike fixed costs that remain fixed in total but change on a per-unit basis, variable costs remain the same per unit, but change in total relative to the level of activity in the business. Revisiting Tony’s T-Shirts, Figure 2.16 shows how the variable cost of ink behaves as the level of activity changes. Step costs are expenses that are constant for a given level of activity, but increase or decrease once a threshold is crossed. Step costs change disproportionately when production levels of a manufacturer, or activity levels of any enterprise, increase or decrease. When depicted on a graph, these types of expenses will be represented by a stair-step pattern.

Within that relevant range, the total costvaries linearly with volume, at least approximately. Outside of therelevant range, we presume the assumptions about cost behavior maybe invalid. Costs that do not change with the level of production or sales within a relevant range. Many prisons and jails analyze step costs based on annual prisoner cohort numbers. If cohorts are fewer, step costs fall because there are fewer people to feed, clothe, and monitor.

Suppose the company is operating at a production capacity of 18,000 units. An example of a step variable cost is the compensation of a quality assurance (QA) worker in the assembly area of a production department. Each QA worker is capable of reviewing asset to equity ratio a certain number of parts per day. Once the production process exceeds that volume level, another quality assurance worker must be hired. Managerial and related cost accounting systems assist managers in making ethical and sound business decisions.

Step costs are costs that remain constant over a range of activity levels but increase to a new level once a certain threshold is crossed. This behavior makes step costs distinct from fixed and variable costs, as they do not change with every unit produced, but instead jump in increments. Understanding step costs is crucial for analyzing cost behavior patterns and creating flexible budgets, as they can significantly impact financial planning and decision-making.