Blogs

Put bonuses are a pleasant a lot more that you might score once getting down currency, if you are no-deposit incentives are provided for signing up. You can also find that you get access to best choices thru mobile phone costs than should you choose almost every other actions. Companies discover the tech much more rates-productive than simply credit payments and you will target sale techniques at the cellular phone payers because of this. For many who direct an active life, up coming and then make a telephone fee is very good as it’s much faster than yourself typing on your own credit facts – as well as it’s not necessary to carry a physical little bit of plastic material. To own software money, your data has already been stored, which means you only need to admission the protection requirements – either only a great fingertip test – and go into the matter you should transfer. Playing with social and you can free Wi-Fi connections can be expose the non-public guidance your store on your own smart phone in order to fraudsters, specifically if you is logged directly into your financial establishment’s software.

What’s cellular look at deposit and you may and therefore banking companies render it? | online casino mahjong 88

Deposit checks on the savings account utilizing your cell phone try an enthusiastic extremely easier ability provided by progressive banking technologies. Following the new steps outlined in this post, plus the offered recommendations and you may security info, you can make by far the most out of mobile consider deposits while you are reducing risks. Before you initiate, look at should your lender offers mobile take a look at deposit. Most major banking companies offer this service, however it is important to confirm this particular feature is available in order to you.

Hold symptoms for cheques at the banks or any online casino mahjong 88 other federally controlled monetary associations will get affect digital cheque deposits. Entry to mobile put demands a qualified account becoming open for 30 days and in a great status, meaning membership with 6 or maybe more not enough finance belongings in a great 12-few days months will not meet the requirements. Having fun with an atm inside your lender’s community can help you prevent costs and ensure a seamless process. And, always prioritize your own protection by going for a server in the a highly-lighted and you will safe place. First, you should download your own bank’s formal cellular app on the application shop before you can put your look at.

- Keep reading to own one step-by-step help guide to the administrative centre One to mobile consider deposit techniques.

- Listen to one tips one tell you not to generate otherwise sign less than a specific line, and you may follow him or her.

- The newest software always brings instantaneous verification, plus the fund are usually readily available inside a business time.

- Casino Kings allows deposits individually through your smartphone merchant, without the need to get into any financial otherwise card details.

As the app is actually installed, open they and you will sign in your bank account making use of your history. Certain banks impose per-deposit costs if the a business exceeds a certain number of month-to-month deals. Fee details is actually intricate on the financial’s agenda and you will will vary widely.

In addition to, just remember that , brokers may additionally costs their charge for using which percentage way of generate deposits otherwise withdrawals. Notably, i place a top increased exposure of day change programs when score mobile currency agents. With a good application, you could potentially done all of the phase of your own trade travel from your mobile device, of signing up thanks to investment so you can establishing investments.

Capture obvious images away from each party of one’s look at

Of many banking institutions and borrowing from the bank unions, large and small, render cellular look at deposit. The easiest method to find out if your financial organization now offers mobile consider deposit is to check your financial app or phone call the lending company or credit connection. Most major banking companies ensure it is cellular consider places & most those dumps obvious in about one three business days.

- To have a far greater experience, download the brand new Pursue app for your iphone 3gs otherwise Android.

- Very first monthly fee might possibly be billed to the mother or father bag 7 days once winning membership.

- It’s managed to make it so you wear’t need wait until you could make they to a great bank place to gain access to the money that someone owes you.

- Most banks do not let mobile places away from 3rd-team monitors, whether or not he or she is signed off to your.

- It’s got high convenience to the participants, as they do not need express its checking account in order to build casino money.

- Luckily, for those who bank with a lender who has a mobile application, you will possibly not have to see a branch so you can deposit an excellent take a look at.

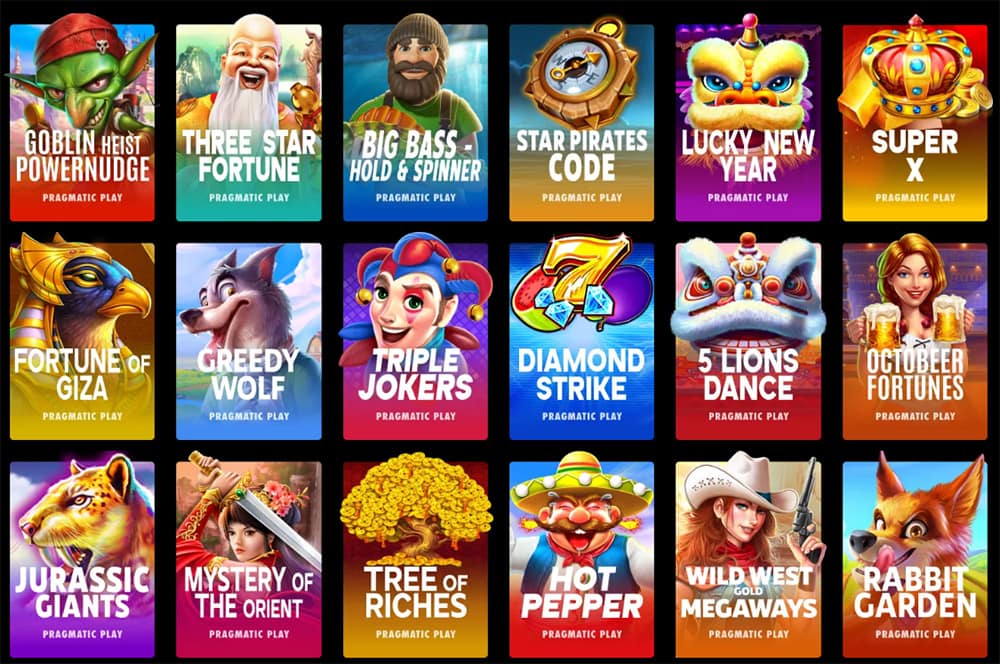

Gambling establishment Kings provides premium training, since the game is enhanced for cellular gameplay, and you can with ease availableness the new gambling enterprises once your deposit by the cellular telephone costs clears. You’lso are limited by $10,one hundred thousand per consider for each cellular deposit having Lender from Sites. Community Checking account which might be more 90 days old can be deposit to $twenty five,100 via a smart device. You’ll have to have a people Journey Family savings you to’s over ninety days dated so you can deposit as much as $50,000.

Sure, their cellular deposit limits receive for each qualified account whenever you choose in initial deposit so you can account as well as on the newest Get into Matter display. Get hold of your certain bank to ensure your existing cellular put limits, because they can will vary considering your account form of and you can banking history. Financing accessibility may be delayed despite you get deposit verification. Banks can be lay holds for the cellular deposits just like typical monitors, particularly for huge numbers or you’lso are a new buyers. The new hold stage depends on issues including the view matter, your account history, as well as the giving lender.

When you’ve extra the newest deposit amount, it’s time for you bring pictures of your own consider. To possess the greatest results, place your check on an apartment, dark-background skin to switch quality. Following, smack the camera symbol on your own mobile application to start the newest camera.

Select company examining, small business finance, team handmade cards, supplier services otherwise go to all of our organization financing cardio. Go shopping with your debit card, and you can lender away from almost everywhere because of the cellular telephone, tablet otherwise pc and more than 15,100000 ATMs and you can 5,100000 branches. With respect to the level of your view, this may obvious in a single to 3 working days. Yet not, your financial can take in initial deposit for some causes, for example membership hobby, prior outstanding inspections otherwise repeated overdrafts, but there is a maximum hold period by government laws. When you are fresh to mobile financial and placing mobile checks, follow the information intricate from the blog post below.

For individuals who’re also unsure simple tips to deposit a check into your membership, you will need to name otherwise see your financial for lots more advice. You may want to go to an actual physical location to done a deposit for these items. Navy Federal will not render, which can be perhaps not guilty of, the product, provider, complete website posts, defense, otherwise confidentiality regulations on the any external third-group web sites.

We are not contractually obligated in any way to offer positive otherwise recommendatory recommendations of their services. You’re free to favor simple tips to deposit your view, and if do you think cellular deposit isn’t for your requirements, that’s very well fine. But not, before you can slam the book about tip, considercarefully what you might be letting go of. Monitors deposited ahead of 10pm ET to the a corporate time can get one day because the day’s put.